Normally, this will certainly be a percentage-based worth of 1% to 10%, depending upon the company, according to the National Association of Insurance Coverage Commissioners (NAIC). Wind as well as hail storm (car insurance). Comparable to those for hurricanes, these are most likely to appear in policies for regions vulnerable to extreme cyclones as well as hail storm, such as the Midwest.

In this situation, the insurance firm pays a percent of costs 80% or 90%. Typical types of health and wellness insurance coverage plan deductibles consist of: Prescriptions.

If you get care from a wellness expert or medical facility that's not consisted of in your insurance provider's network of accepted providers, you might have to meet a different, out-of-network deductible, and that one could be higher than for in-network care (cheapest). There are a couple of different ways companies take care of family members health insurance policy plans.

Various other insurers impose what's understood as an ingrained deductible, in which each participant of your family members need to satisfy a set restriction prior to insurance coverage applies to their care - cheaper cars. FAQs, What is the difference between an insurance policy costs and a deductible?

The team doesn't keep examples, gifts, or finances of product and services we evaluate. cheapest car insurance. On top of that, we maintain a different service group that has no influence over our approach or referrals.

You're responsible for the very first $1,000 of damages and also your insurance policy firm is in charge of the other $1,000 of protected damages. Crash and thorough are both most common insurance coverages with a deductible. cheapest car insurance. Crash-- this protection helps pay for damages to your vehicle if it hits one more car or item or is struck by another automobile.

The Of Car Insurance Deductibles And Liability Limits

insurance companies trucks low cost auto cheap

insurance companies trucks low cost auto cheap

cars insurance affordable insurance companies affordable auto insurance

cars insurance affordable insurance companies affordable auto insurance

There are likewise some various other points to recognize concerning deductibles. There are no deductibles for obligation insurance policy, the protection that pays the other person when you trigger a crash. Cars and truck insurance deductibles relate to each crash you remain in. If you obtain right into 3 crashes in a plan period and also have a $500 deductible, you'll commonly be accountable for $500 for each case.

What is an Automobile Insurance Deductible? Your automobile insurance coverage deductible is the quantity you'll be responsible for paying in the direction of the costs due to a loss before your insurance coverage pays.

Picking a greater insurance deductible might reduce your vehicle insurance costs. When Do You Pay an Auto Insurance Deductible?

What Are Responsibility Limits as well as Exactly How Do They Work? Your automobile insurance policy responsibility protection limits, additionally described as limitation of responsibility, are one of the most your insurance coverage will pay to another celebration if you are lawfully liable for a mishap (business insurance). Selecting a higher restriction offers you extra protection if a crash takes place.

Contact your neighborhood independent representative or Travelers representative to learn more about the insurance coverages and responsibility limit that is ideal for you. What are Personal Responsibility Umbrella Policies and also Are They Called for? An umbrella plan is additional obligation protection over and also over the restrictions of your auto insurance coverage. Umbrella policies are not called for and available insurance coverage restrictions and also eligibility demands might vary by state.

The ordinary car insurance coverage deductible is the typical amount vehicle drivers pay upfront when they need to sue with their car insurance policy suppliers. After you pay this amount, the insurance provider covers the price of the certifying damages or loss - auto insurance. Picking a car insurance policy deductible can have major economic implications, so it is necessary to consider the numerous choices with the help of an insurance agent to make the appropriate option for you and your family members (cheaper cars).

The How Much Can You Save By Raising Your Auto Insurance ... PDFs

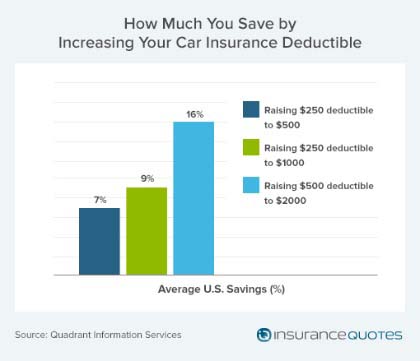

When you select a higher insurance deductible for your plan, you will certainly pay a reduced costs for insurance coverage. Pocketbook, Hub notes that you can save concerning 6 percent by choosing a $2000 deductible as opposed to a $1000 deductible, which may or might not make feeling depending on the price of your plan.

If you have substantial cost savings, you might favor to have a reduced deductible as well as somewhat greater regular monthly payment to avoid having to come up with a bigger amount in case of a mishap case. The Equilibrium blog keeps in mind that you must additionally consider your probability of having a claim.

In these instances as well as other risky situations, you ought to consider choosing a reduced deductible - cheap car. Low-risk vehicle drivers that hardly ever file insurance claims may be a lot more comfy with high-deductible plans. When buying a car insurance plan, ask each agent to give you estimates with numerous deductibles. If you would not have the ability to recover the price of your insurance deductible within three years of a claim with the reduced costs, think about selecting a reduced deductible plan.

In a situation where you do not have the money to settle your insurance deductible to a technician, the insurance coverage company will certainly send you a look for the damage price quote minus the deductible get more info - cars. You would not have enough funds to repair the damage to the lorry, which can substantially lower its worth.

You might be able to locate even more details regarding this and also comparable material at (insurance affordable).

business insurance insurance auto cheap insurance

business insurance insurance auto cheap insurance

Insurance deductible defined An insurance deductible is the quantity of money that you are accountable for paying toward an insured loss. When a catastrophe strikes your home or you have a cars and truck mishap, the deductible is deducted, or "subtracted," from what your insurance pays toward an insurance claim. Deductibles are how danger is shared between you, the policyholder, and your insurance company (cheap car insurance).